Menu

Late Utility Bills and Bankruptcy

March 25th, 2021

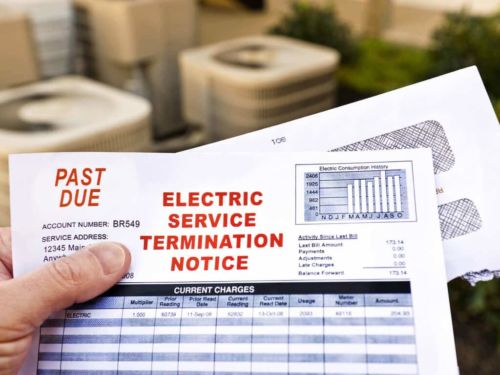

When you have utility bills stacking up and are considering a bankruptcy filing, you are likely to wonder what is and is not included. When you fear your utilities being shut off, you need to know what options are available to you. The Jones Law Firm knows how complicated this can be, and we want to help.

Utility Bills and Chapter 7 Bankruptcy

If you are facing a utility shut-off, such as electricity, gas, water, or telephone, because you can’t catch up on bills, a Chapter 7 bankruptcy filing may help keep your utilities on. Under the Automatic Stay, creditors, government entities, and collection agencies are temporarily barred from pursuing debtors for the finances owed. The moment you file for bankruptcy, you are protected and the automatic stay goes into effect. This includes prohibiting the utility companies from shutting off or refusing to provide service just because you filed for bankruptcy or were late on your payments.Utility Bills and Chapter 13 Bankruptcy

In Chapter 13 bankruptcy, utility bills will be lumped into your unsecured debts and will be paid through the Chapter 13 repayment plan. In most Chapter 13 bankruptcies, you’ll only pay back a portion of their unsecured debt through the plan. You will, however, need to stay current on your utility bills. Whether you file for Chapter 7 or Chapter 13 bankruptcy, you must continue to make your regular utility payments, as bankruptcy does not discharge current or future payments.Adequate Assurance To Repay Bills

Part of the bankruptcy process is showing adequate assurance that you will pay future utility bills. However, knowing what adequate assurance is can be tricky. Often times, the court and creditors will accept the following as a form of adequate assurance:- A letter of credit

- Cash deposit

- Certificate of deposit

- Surety bond

- Prepayment

Know your Bankruptcy Options in Columbus and Central Ohio

When it comes to filing for bankruptcy in Columbus and central Ohio and piling utility debts, you need to know what options are available to you. If you are facing debts you can’t pay and are considering bankruptcy, learn more about how The Jones Law Firm can help you or contact us for a free consultation about your options.Categories: General Bankruptcy